BBB asks third parties who publish complaints, reviews and/or responses on this website to affirm that the information provided is accurate. Consider other options first.īBB Business Profiles may not be reproduced for sales or promotional purposes.īBB Business Profiles are provided solely to assist you in exercising your own best judgment.

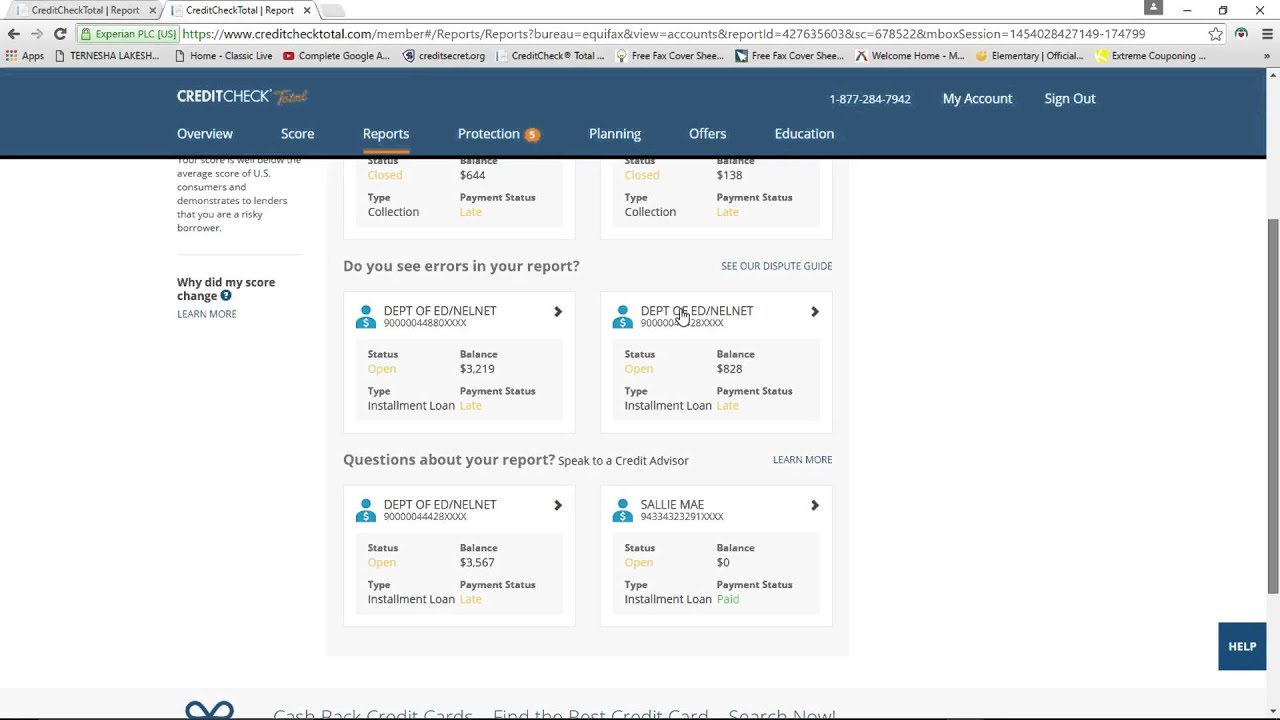

I told Jay I didn't want to write this post because it's not who I am but I felt compelled to do it to help anyone else who is thinking about spending money to boost their credit. No I am still out ****0, have 1 tradeline that I did not want, and was not able to get an affordable rate for a home because the window has closed. The expectations they set were favorable and I would have been happy if I either got what I was told I paid for in the timeframe I was given or received a refund because that did not happen. However, now that I have a Macy's card posting on my credit I am being told "I cannot get a refund because money was paid and tradelines posted". I have been going back and forth with Jay for weeks now letting him know I wanted a refund because I clearly did not get what I paid for and it took MUCH longer than I was told. I was told they initial posting didn't happen because my credit had a lock on it so I spent 7 hours calling 8 different companies only to hear the same thing, there was no lock on my credit at all!Ī week ago (about 10 weeks after I started) I had a *k Macys card post to my credit which boosted it a whopping 13 points. I timed it to buy a home but nothing had posted for over 2 months and by that time rates were 1.25% higher. I paid **** dollars to ad 2 tradelines (a *** card and a **k card each around 20 years old) I was told this would post in a couple weeks. To learn more about Citi Ready Credit, click here.After going through the credit sweep program for 18 months I decided to try to add tradelines since the credit sweep only added 80-90 points. If you don’t have a Citi account, you can apply for one and then request for Ready Credit by logging in to Citibank Online or calling our 24x7 CitiPhone helpline. 20000) gets credited, you are eligible for Ready Credit after your first salary deposit, up to 5 times your salary credit to a maximum of Rs. If you have an account with us, where your salary ( > Rs.

21 DAY CREDIT SWEEP HOW TO

How to Apply for Citi Suvidha Account customers:

21 DAY CREDIT SWEEP OFFLINE

Offline options like cheques, demand drafts, NEFT, RTGS or ECS are also available. You can make easy payments to your Ready Credit Account via Citibank Online or the mobile app. If there is no usage, there will be no interest payable.

The interest is calculated on a daily reducing balance and charged only on the amount you use and for the time you use it.

21 DAY CREDIT SWEEP FULL

Once you open your Ready Credit Account, you have full access to the credit limit whenever you want it, via ATM, Cheque book, Citibank Online, Citi Mobile, 24x7 CitiPhone Banking, and millions of merchant establishments worldwide.If you repay the Rs.1,00,000, and have not used any more of the Ready Credit funds, your available cash line once again becomes Rs.5,00,000. if you have a cash line of Rs.5,00,000, and you use Rs.1,00,000 for a family function, you will have Rs.4,00,000 left for other purposes. Each repayment proportionately increases your available cash line.Only 5% monthly repayment of the principal outstanding and monthly interest is mandatory. You have the exceptional financial flexibility to choose what to pay and when and there’s no pre-closure penalty. if you use Rs.10,000 for 5 days, you need only pay interest for 5 days, not for the whole month.

0 kommentar(er)

0 kommentar(er)